Stochastic Indicator For Binary Options Download

/binary-option-trading-signals-free.html. Fraud Fraud within the market is rife, with many binary options providers using the names of famous and respectable people without their knowledge. This positions binary options as a form of gambling, and the administrator of the trading as something akin to a casino, as opposed to an. On October 19, 2017, raided 20 binary options firms in London.

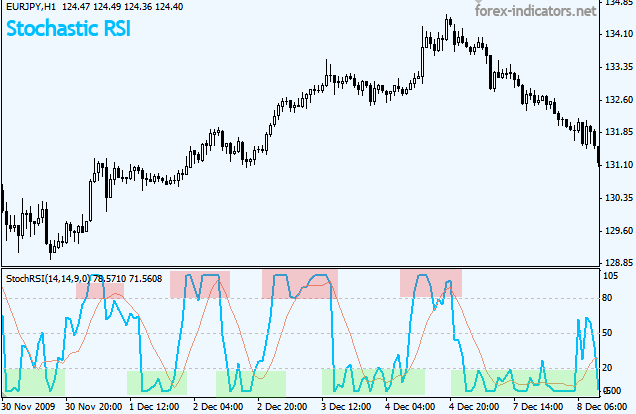

Submit by Christian This Forex trading system utilizes two classic indicators: All RSI and Stochastic cross alert sig overlay; I use the two indicators on two different time frames. The All RSI Indicator ( 14 period ) see the 4H chart (in the subwindow on the sreen), while the Stochastic cross alert sig overlay (settings 5, 3, 3) is used on a 15 minute chart (the opening chart). The idea is RSI on the 4H chart will show the direction of the price while the Stochastic will give us the actual trade signal. Time Frame 15 min expires time 60 min Buy Call 1. All on 4H tine frame is above the 50 level 2. Arrow of buy of the on the 15 minute chart basic on the screen.

Enter a Buy call at the opening of the next candle. ( For an best entry, wait that the price retraces 3 pips below price opening candle). All RSI indicator on 4H tine frame is below the 50 level 2. Arrow of sell of the Stochastic cross alert sig overlay on the 15 minute chart basic on the screen. Enter a Buy put at the opening of the next candle. ( For an best entry, wait that the price retraces 3 pips above price opening candle).

Binary Options Strategy: RSI with stochastic: this Forex trading system utilizes two classic indicators: All RSI and Stochastic cross alert sig overlay; I use the two indicators on two different time frames. The All RSI Indicator ( 14 period ) see the 4H chart (in the subwindow on the sreen), while the Stochastic cross alert sig overlay (settings 5, 3, 3) is used on a 15 minute chart (the. Trading Strategy Drake Delay Stochastic based on indicators and is designed for working with binary options and other financial instruments. Trade is conducted at the turn of the boundaries of the channel with the confirmation of Stochastic. Binary Options ‘3’ Strategy That Works + Video. Download indicators and templates: eDisk and Uloz.To. Stochastic Indicator Signals Stochastic oscillator representation. Not only is it very well known for oscillation, but also for its technical analysis capabilities. The direction of the oscillator coincides with the price movement.

Do not trade if RSI indicator is> 70 or less than 20 For other Trading plataform open 2 charts: 1° 15 min with stochastic indicator (5,3,3) and 2° 4H chart with RSI (14 period). Buy call Relative Strength Index on 4H time frame is above the 50 level. Stochastic oscillator (5,3,3) on the 15 minute chart crosses upwards, from Oversold territory and buy put when crosses > 20 level. Buy put Relative Strength Index on 4H time frame is below the 50 level.

Stochastic oscillator (5,3,3) on the 15 minute chart crosses downward, from Overbought territory and buy put when crosses.

What is Zig Zag Indicator The Zig-Zag indicator is a basic tool that analysts use to find out when a security’s trend is reversing. By determining the support and resistance areas, it helps to identify significant changes in price while filtering out short-term fluctuations, thus eliminating the noise of everyday market conditions. Binary options trading a scam. It is an excellent tool for any trader who follows indicators that use swing highs and swing lows. The Zig-Zag indicator is an effective tool for analyzing historical data.

/binary-options-money-management-system.html. It is only based on hindsight and is not predictive in any way. It is based on the past prices of securities and cannot forecast the next swing highs and swing lows. Trading NOTES • these ( the best trading tools all traders MUST HAVE) • Use a demo account or a small live account first to practice this trading system Even though the Zig-Zag indicator is not predictive, it is still very useful. • It is often used in conjunction with applications such as Elliott wave counts. • Analysts can also use the historical highs and lows to draw lines to identify Fibonacci projections and retracements. • Chart patterns such as double bottoms, double tops, and head and shoulders can also be determined.